Apple Company's net worth refers to the total value of all its assets, which include its physical assets, such as its buildings and equipment, as well as its intangible assets, such as its brand name and intellectual property. It is a crucial indicator of the company's financial health and stability, as it represents the total value that shareholders would receive if the company were to be liquidated.

Apple's net worth has grown significantly over the years, largely due to the success of its popular products, such as the iPhone, iPad, and Mac. The company's strong brand recognition and loyal customer base have also contributed to its overall value. Apple's net worth is important because it provides insights into the company's financial performance and its ability to generate profits and returns for shareholders. It also serves as a benchmark for comparing Apple to its competitors in the technology industry.

To delve deeper into Apple's net worth and its implications, we will explore the company's financial history, its major revenue streams, and its investment strategies in the following sections. We will also discuss the factors that could potentially impact Apple's net worth in the future.

Read also:Mathilda Ringwald A Rising Star Illuminating The Entertainment World

Essential Aspects of Apple Company Net Worth

Apple company net worth is a crucial indicator of its financial health and stability. Here are seven key aspects to consider when examining this metric:

- Total assets

- Intangible assets

- Revenue streams

- Profitability

- Shareholder value

- Industry comparison

- Future prospects

Total assets represent the value of all that Apple owns, including its physical property, inventory, and financial investments. Intangible assets, such as brand recognition and intellectual property, are also a significant part of Apple's net worth. Revenue streams, primarily from product sales and services, indicate the company's ability to generate income. Profitability, measured through metrics like gross and net profit margins, shows how efficiently Apple converts revenue into profit. Shareholder value reflects the worth of investors' ownership in the company. Industry comparison benchmarks Apple's net worth against its competitors, providing context for its financial performance. Finally, future prospects consider factors that could impact Apple's net worth, such as technological advancements and market trends.

1. Total assets

Total assets represent the foundation of Apple Company's net worth, encompassing everything the company owns and controls. It is a crucial component that significantly influences the overall financial health and stability of Apple.

The connection between total assets and Apple Company's net worth is direct and substantial. Total assets provide a snapshot of the company's resources, including its physical assets (such as buildings, equipment, and inventory) and intangible assets (such as patents, trademarks, and brand value). These assets are essential for Apple to generate revenue and create value for its shareholders.

For instance, Apple's manufacturing facilities and retail stores are vital assets that enable the production and distribution of its products. Its vast intellectual property portfolio, including patents and copyrights, protects its innovative technologies and designs, providing a competitive edge in the market. By effectively managing and leveraging its total assets, Apple can maximize its revenue streams, optimize profitability, and enhance its overall net worth.

2. Intangible assets

Intangible assets play a pivotal role in shaping Apple Company's net worth. Unlike tangible assets, which have a physical form, intangible assets are non-physical and often include intellectual property, brand recognition, and customer loyalty. These assets are crucial drivers of Apple's financial success and long-term growth.

Read also:Ultimate Guide To Essence Mascara Transform Your Look With Lush Lashes

One of the most valuable intangible assets for Apple is its brand recognition. The company has spent decades cultivating a strong brand identity that resonates with consumers worldwide. Apple's brand is synonymous with innovation, design, and quality, which allows it to command premium prices for its products and services.

Another critical intangible asset for Apple is its intellectual property portfolio. The company holds numerous patents and trademarks that protect its unique technologies and designs. This portfolio provides Apple with a competitive advantage and helps to ensure that its products remain differentiated in the marketplace.

Customer loyalty is another intangible asset that contributes to Apple's net worth. Apple has a large and loyal customer base that repeatedly purchases its products and services. This loyalty is driven by factors such as the company's user-friendly operating system, its seamless integration between devices, and its commitment to customer satisfaction.

In conclusion, intangible assets are a vital component of Apple Company's net worth. These assets, including brand recognition, intellectual property, and customer loyalty, provide the company with a sustainable competitive advantage and contribute significantly to its long-term financial success.

3. Revenue streams

Revenue streams are the lifeblood of Apple Company's net worth. They represent the various channels through which the company generates income and ultimately increases its overall value. Understanding the connection between revenue streams and Apple Company's net worth is crucial for assessing the company's financial health and long-term growth prospects.

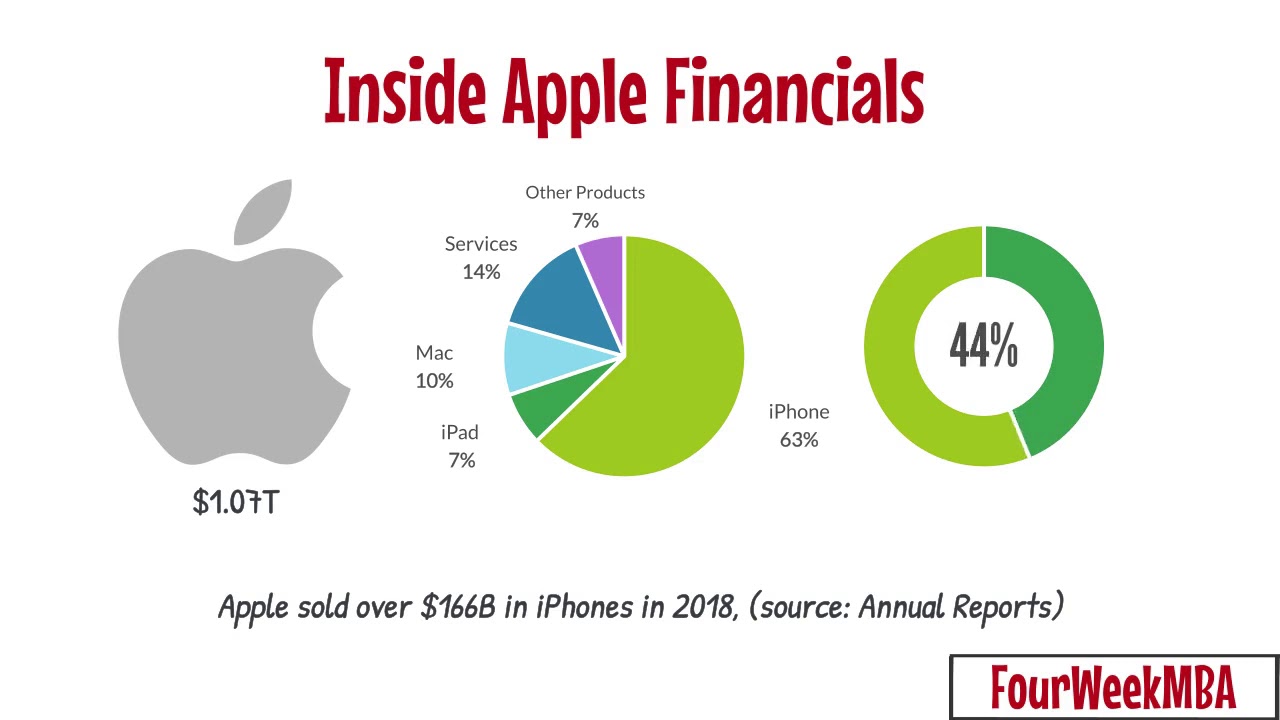

Apple's primary revenue streams include product sales, services, and licensing. Product sales, particularly of its iconic iPhone, iPad, and Mac devices, consistently account for the majority of the company's revenue. Services, such as the App Store, iCloud, and Apple Music, have become increasingly important, providing recurring revenue and enhancing customer loyalty. Licensing revenue is generated from companies that use Apple's intellectual property, such as its operating systems and software.

The strength and diversity of Apple's revenue streams contribute significantly to its net worth. By relying on multiple sources of income, the company reduces its exposure to fluctuations in any single market or product category. This stability allows Apple to invest in research and development, expand its product offerings, and pursue new growth opportunities.

Moreover, Apple's ability to generate consistent and growing revenue streams enables it to attract and retain investors. Shareholders recognize the value of the company's strong financial performance and its potential for future growth. As a result, Apple's stock price tends to reflect the positive outlook associated with its revenue-generating capabilities.

In conclusion, revenue streams are a critical component of Apple Company's net worth. The company's diverse and robust revenue streams provide a solid foundation for its financial success and long-term growth. Understanding the connection between revenue streams and net worth is essential for investors, analysts, and anyone interested in the financial well-being of Apple Company.

4. Profitability

Profitability is a crucial element that significantly impacts Apple Company's net worth. It refers to the company's ability to generate profits from its operations and is a key indicator of its financial performance and overall health. Understanding the connection between profitability and Apple Company's net worth is essential for various stakeholders, including investors, analysts, and business leaders.

Apple's profitability is primarily driven by its strong brand recognition, loyal customer base, and efficient supply chain management. The company's products, particularly the iPhone, iPad, and Mac, command premium prices due to their perceived value and superior user experience. Apple's effective cost control measures, including optimized production processes and strategic partnerships with suppliers, contribute to its healthy profit margins.

High profitability allows Apple to reinvest in its business, driving further growth and innovation. The company allocates a substantial portion of its profits to research and development, enabling it to stay at the forefront of technological advancements. Additionally, Apple's commitment to shareholder value is reflected in its consistent dividend payments and share buyback programs, which are made possible by its strong profitability.

In conclusion, profitability is a vital component of Apple Company's net worth. The company's ability to generate and sustain high profit margins has a direct impact on its overall financial health and long-term growth prospects. Understanding the connection between profitability and net worth is crucial for stakeholders to make informed decisions and assess the company's financial performance.

5. Shareholder value

Shareholder value is the worth of an ownership interest in a company, representing the claims of shareholders to the company's assets and earnings. In the context of Apple Company, shareholder value is closely tied to its net worth, which reflects the overall financial health and stability of the company.

- Financial performance: Shareholder value is directly influenced by Apple's financial performance, as strong profitability, revenue growth, and asset management practices contribute to an increase in net worth and, consequently, shareholder value.

- Dividend payments and share buybacks: Apple's commitment to returning value to shareholders through dividend payments and share buyback programs directly impacts shareholder value by increasing the cash flow and equity value of shareholders.

- Market perception and investor confidence: Positive market sentiment and investor confidence in Apple's future prospects can lead to an increase in its stock price, which directly affects shareholder value.

- Long-term growth prospects: Apple's ability to innovate, expand into new markets, and maintain its competitive edge is crucial for sustainable shareholder value creation.

In conclusion, the connection between shareholder value and Apple Company's net worth is multifaceted, encompassing financial performance, dividend policies, market perception, and long-term growth prospects. Understanding this relationship is essential for investors and stakeholders to make informed decisions and assess the potential return on their investment.

6. Industry comparison

Industry comparison is a fundamental aspect of assessing Apple Company's net worth as it provides valuable insights into the company's performance relative to its peers and the broader technology industry. By comparing Apple's financial metrics, market share, and competitive landscape with those of its industry counterparts, analysts and investors can gain a deeper understanding of the company's strengths, weaknesses, and potential growth opportunities.

One key metric used in industry comparison is revenue growth. Apple's revenue growth rate, compared to that of its competitors, provides insights into the company's ability to expand its market share and capture new customers. Similarly, comparing Apple's profit margins with industry averages helps analysts evaluate the company's cost structure, pricing strategies, and overall profitability.

Market share comparison is another important aspect of industry comparison. Apple's market share in the smartphone, tablet, and personal computer markets, relative to its competitors, indicates the company's brand strength, customer loyalty, and competitive position. A high market share often translates into greater pricing power, economies of scale, and increased brand recognition.

Industry comparison also involves analyzing the competitive landscape. Apple faces competition from various technology companies, including Samsung, Google, and Microsoft. Understanding the strategies, product offerings, and market positioning of these competitors helps investors assess Apple's competitive advantages and potential risks.

By conducting thorough industry comparisons, investors and analysts can gain valuable insights into Apple Company's net worth. This understanding enables them to make informed investment decisions, identify potential growth areas, and assess the company's overall financial health and prospects.

7. Future prospects

Future prospects play a critical role in determining Apple Company's net worth. The company's ability to maintain and grow its net worth is heavily influenced by its strategic planning and execution, as well as external factors that may impact its business environment.

- Product innovation: Apple's success has been largely driven by its ability to consistently introduce innovative products that meet the evolving needs of consumers. Continued focus on research and development, as well as a deep understanding of customer preferences, will be essential for maintaining its competitive edge and driving future growth.

- Market expansion: Apple has a strong presence in developed markets, but there is significant growth potential in emerging markets. Expanding into these markets, while adapting products and marketing strategies to local needs, could contribute to increased revenue and net worth growth.

- Services revenue: Apple has been shifting towards a services-oriented business model, with services such as the App Store, iCloud, and Apple Music generating a growing portion of revenue. Expanding the services portfolio and enhancing customer engagement will be key to sustaining revenue growth and increasing net worth.

- Environmental, social, and governance (ESG) factors: Investors and consumers are increasingly considering ESG factors in their decision-making. Apple's commitment to sustainability, social responsibility, and ethical practices can positively impact its reputation and long-term net worth.

By successfully navigating these future prospects, Apple Company can continue to enhance its net worth, drive shareholder value, and maintain its position as a leading technology company.

FAQs on "Apple Company Net Worth"

This section addresses frequently asked questions related to Apple Company's net worth, providing concise and informative answers.

Question 1:What factors contribute to Apple's high net worth?

Apple's net worth is influenced by a combination of factors, including strong brand recognition, loyal customer base, diversified revenue streams, efficient supply chain management, and innovative product offerings.

Question 2:How does Apple's net worth compare to its competitors?

Apple consistently ranks among the most valuable companies globally, with a net worth significantly higher than many of its competitors in the technology industry.

Question 3:What are the key drivers of Apple's net worth growth?

Apple's net worth has grown steadily over the years, driven by factors such as increasing product sales, expanding services revenue, and strategic acquisitions.

Question 4:What are the potential risks to Apple's net worth?

Potential risks to Apple's net worth include intense competition, technological disruptions, economic downturns, and changes in consumer preferences.

Question 5:How does Apple's net worth impact investors?

Apple's high net worth and strong financial performance make it an attractive investment for many individuals and institutional investors seeking long-term growth.

Question 6:What is the outlook for Apple's net worth in the future?

Apple's future net worth growth will depend on its ability to maintain its competitive edge, innovate new products and services, and adapt to changing market dynamics.

In summary, Apple Company's net worth is a reflection of its strong financial performance, brand value, and growth prospects. Understanding the factors that contribute to its net worth is crucial for investors, analysts, and stakeholders alike.

Moving forward, we will delve into the strategies and initiatives that Apple is implementing to sustain and enhance its net worth in the years to come.

Tips on Understanding "Apple Company Net Worth"

Understanding the concept of "Apple Company Net Worth" is crucial for investors, analysts, and anyone interested in the financial well-being of the company. Here are a few tips to help you grasp this important metric:

Tip 1:Comprehend the Components of Net Worth: Apple's net worth encompasses its total assets, including tangible assets like buildings and equipment, and intangible assets like brand recognition and intellectual property.

Tip 2:Analyze Revenue Streams: Apple's net worth is heavily influenced by its revenue streams, which include product sales, services, and licensing. Understanding the contribution of each revenue stream is essential.

Tip 3:Assess Profitability: Apple's profitability, measured through metrics like gross and net profit margins, provides insights into the company's efficiency in converting revenue into profit.

Tip 4:Consider Industry Comparison: Comparing Apple's net worth and financial performance to its competitors in the technology industry helps gauge its relative strength and weaknesses.

Tip 5:Evaluate Future Prospects: Apple's net worth is influenced by its future prospects, including its ability to innovate, expand into new markets, and adapt to changing technological landscapes.

Summary: By considering these tips, you can gain a deeper understanding of Apple Company's net worth, its drivers, and its implications for investors and stakeholders.

Moving forward, we will explore the strategies and initiatives that Apple is implementing to sustain and enhance its net worth in the years to come.

Conclusion

In conclusion, Apple Company's net worth is a multifaceted metric that reflects the company's financial health, brand value, and long-term growth prospects. Understanding the key drivers of Apple's net worth, such as its strong brand recognition, loyal customer base, diversified revenue streams, and innovative product offerings, is crucial for investors, analysts, and stakeholders alike.

As Apple continues to navigate the rapidly evolving technology landscape, its ability to maintain its competitive edge, adapt to changing consumer preferences, and execute its strategic initiatives will be critical in determining the trajectory of its net worth going forward. With a strong foundation and a proven track record of success, Apple is well-positioned to continue delivering value to its shareholders and stakeholders.